Investment Philosophy

Extensive work has to be carried out in sourcing candidates for investments. Bull Capital through its extensive network and in-depth in-house analysis generates numerous investment ideas, proactively originates deals, and reviews a large number of companies on a constant basis.

The Greater China Region is a market with ample investment opportunities but with significant risks stemming from improving, but often poor, business ethics and corporate governance. Bull Capital exercises strong discipline, sticks strictly to its investment criteria, and adopts a patient approach throughout business cycles to focus on a limited number of outstanding opportunities able to provide long term value creation.

Bull Capital believes that the entry price of investment is the key to future returns and has to be able to withstand market volatility. In turn it enables the Investment Manager to fulfill its endeavor of being a long term stable financial partner for its portfolio companies throughout business cycles.

Investment Strategy

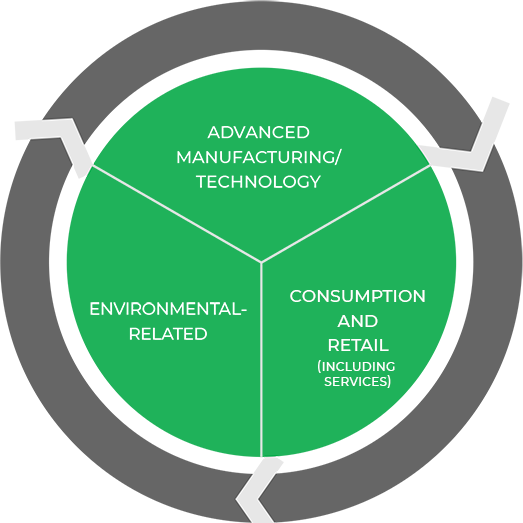

Bull Capital makes direct investments in Great China, primarily in high-growth, scalable, market-leading companies with a particular emphasis on the consumption/retail and services, high-end manufacturing, technology and environment-related sectors. Portfolio companies will generally be focused on domestic markets within the Greater China Region and have the ability to compete internationally.

Focus on Industry

Leaders

Bull Capital focuses primarily on companies that are leaders/emerging leaders in the their sectors as they are likely to benefit more from the effects of globalization relative to smaller players, which will further improve their competitive position and mitigate the effects of downward business cycles. As a financial partner, the Fund’s role would be to assist portfolio company management to capitalize on the positive effects of globalization.

Focus on Companies with a Proven Business Model & Scalability

- strong management team/owner with vision and capability to implement a value creation strategy;

- a cost leader or superior pricing power;

- differentiated technologies or products with high barriers to entry;

- ability to attract loyal customers; and

- high growth potential with strong cash generative business models through various business cycles.

Focus on Privately

Owned Enterprises

Bull Capital makes significant minority investments and acts as a long term partner to the founding shareholders/management.

Sectors

Focus on consumption/retail and services, high-end manufacturing, technology and environment-related sectors.

Sustainable economic growth based on higher value-added production and technology improvements will lead to higher consumption and demand for services in China, which in turn will exert more pressure on the environment. Demand for better control of pollution to improve the quality of life will increase demand for environmental-related products and services.